- The Banking Brief

- Posts

- Deep Dive: Revolut's AI Assistant

Deep Dive: Revolut's AI Assistant

3-minute read

🔥 Today’s Golden Nuggets

Revolut’s AI assistant enters testing – aims to become 52M users' "financial companion"

Starling’s chatbot drives 68% weekly engagement – sets new UX benchmark

JPMorgan sounds AI security alarm amid fintech feature race

1 big thing: Revolut’s AI assistant aims to own your financial identity

Revolut will soon launch an AI financial assistant for its 52.5M+ users, shifting from transactional banking to behavioral guidance – a strategic play to lock in customer loyalty amid fierce neobank competition.

Why it matters: This isn’t a chatbot – it’s more like a gateway to monetizing financial identity. By analyzing spending patterns, life goals, and hidden habits, Revolut could:

→ Cross-sell mortgages/credit at 3x industry conversion rates

→ Preempt rivals like Starling (already seeing high weekly engagement with its AI tool)

→ Build the richest EU financial behaviour dataset

Driving the news:

Rollout starts "shortly" after Bloomberg-confirmed testing

Gradual 2025 expansion planned across 100+ markets

Part of broader ecosystem play: ATMs with facial recognition + EU mortgages launching in weeks

Zoom in: How it works

The AI adapts to individual behaviour like:

Travelers see "Track airport lounge spend" prompts with dynamic budgets

Food enthusiasts get restaurant vs. grocery analytics with waste reduction tips

Investors receive real-time portfolio nudges during market volatility

Revolut’s promise - Guiding smarter money habits through enhanced decision-making.

Yes, but: JPMorgan CISO warns rushed AI deployments risk "catastrophic security failures" via third-party code vulnerabilities.

Be smart: This is a data land grab. Revolut needs this AI moat before Apple/Google embed similar tools natively in wallets. Win here, and they could become the EU’s financial identity layer.

2. Competitor deep dive: The AI banking arms race

Why it matters: 51% of consumers now demand AI financial guidance – with under-35s 3x more likely to trust algorithms over humans.

Player | AI Move | Edge | Risk |

|---|---|---|---|

Starling | Spending analytics via Google Gemini | 68% weekly engagement | Avoids financial advice (regulatory limits) |

Walmart | GenAI shopping assistant + stablecoin plans | Captures low-income users | 22% BNPL default rates |

JPMorgan | Evident AI leader but urges caution | Trust advantage | Slow feature rollout |

Klarna | POS device financing via Visa Flex | Targets $573B phone gap | Bias in credit algorithms |

Competitor | Strengths & Focus Areas |

|---|---|

N26 | Unified EU banking, investment tools, zero-fee international transactions, long-term financial health5 |

Monzo | UK-centric, real-time analytics, AI-powered cash flow predictions, savings automation |

Starling Bank | SME focus, multi-currency support, robust business banking, FSCS protection6 |

Payoneer | Global cross-border payments, multi-currency accounts, freelancer-friendly6 |

Bunq | Sustainable banking, automated bookkeeping, instant payments, green perks6 |

Mercury | US tech startups, API banking, investor-friendly features, no monthly fees6 |

Regulatory fault line: Brexit divergence forces Revolut to rebuild features for EU/UK separately – especially because of crypto/fraud rules.

Bottom line: Audit your AI security by Q3 – JPMorgan’s warning signals coming regulatory scrutiny on "black box" financial guidance.

3. Revolut’s endgame: Becoming the first global bank

Expansion blueprint:

Licensing blitz: 10 banking applications pending + €1B France investment

Credit offensive: Mortgages launching in Lithuania/Ireland/France with 1-day approvals

Physical reach: Spain ATMs dispensing cash/cards via facial recognition

Monetization playbook:

Free AI assistant hooks users

Mortgage/credit products target prime segments

Business banking (Revolut Pay + BNPL(Buy Now Pay Later) locks in SMBs

Brutal truth: With 52.5M users but thin profitability outside forex, Revolut needs this AI ecosystem to justify its $45B valuation.

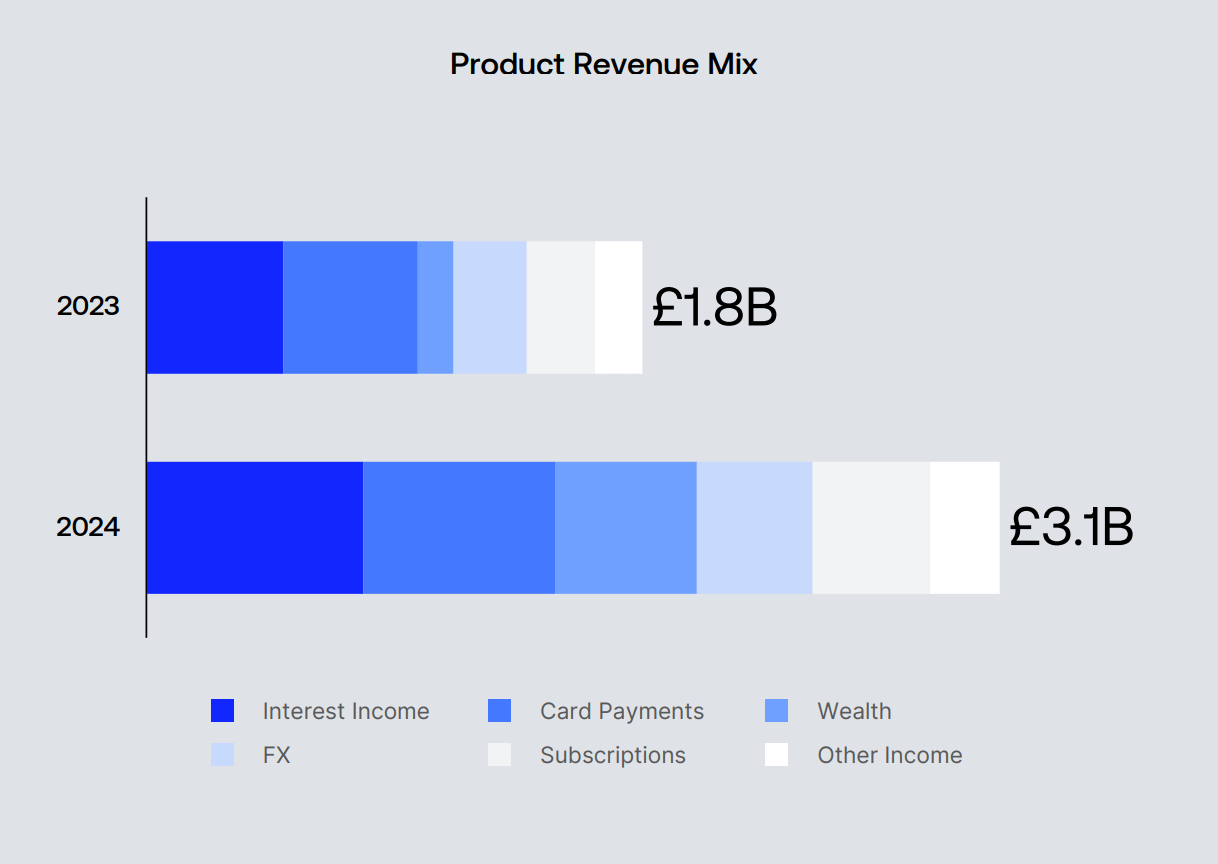

Revolut’s Product Revenue mix

That’s time. See you in the next!