- The Banking Brief

- Posts

- Shoprite's Banking Ambitions, Wesbank gets a brand new CEO, Nedbank Enters the MVNO game

Shoprite's Banking Ambitions, Wesbank gets a brand new CEO, Nedbank Enters the MVNO game

The Banking Brief

Golden Nuggets

Robert Gwerengwe, the man steering FNB’s DirectAxis and personal segment, takes the wheel as CEO of WesBank, signalling fresh leadership for SA’s vehicle finance giant.

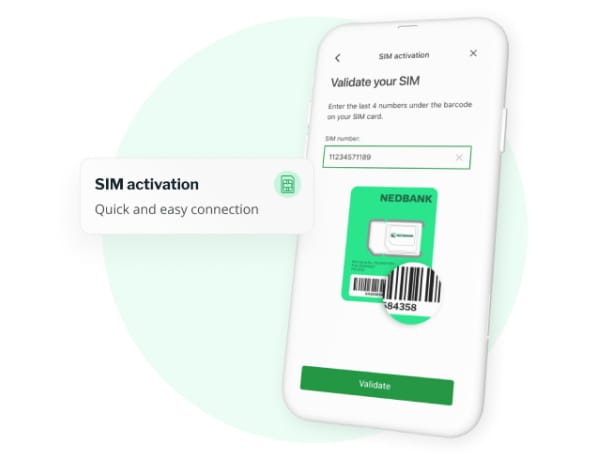

Nedbank is no longer just banking your money—they've jumped into the mobile game with Nedbank Connect, a brand-new Mobile Virtual Network Operator (MVNO) aiming to disrupt the SA telecom scene for their customers.

Shoprite announces further banking ambitions.

International Giant Access Bank Eyes South African Market with R2.8 Billion Bid for Bidvest Bank.

Main Stories

Inside Shoprite’s Banking Ambitions

Why it matters: Shoprite plans to roll out a zero-cost bank account, creating a banking option integrated seamlessly with its retail and digital platforms. This disrupts traditional banking by offering convenience and personalised rewards tied directly to everyday spending on essentials, groceries, and household items. Their use of advanced AI and analytics further refines customer targeting and risk profiling.

The Unfolding Narrative: With 1.2 billion customer visits annually, Shoprite commands one of the largest consumer databases in Africa. This includes granular purchase histories, rewards activity, and digital shopping patterns from Sixty60. Traditional banks rely heavily on credit scores and limited data, but Shoprite’s comprehensive insight into daily consumer behaviour allows them to design highly tailored, lower-risk financial products.

So what: Shoprite could reshape financial inclusion in South Africa by providing affordable banking to millions who transact daily at their stores but remain underserved by traditional banks. This model leverages Shoprite’s scale and customer trust to bypass expensive banking infrastructure, potentially eating into incumbents’ market share.

New Boss at WesBank: Robert Gwerengwe Takes the Helm

Why it matters: WesBank is one of South Africa’s leading vehicle finance companies, underwriting millions of loans and leases for vehicles. Robert Gwerengwe’s appointment as CEO marks a significant leadership transition that could reshape the company’s strategies in a competitive financial market.

The Backstory: Gwerengwe was previously the CEO of DirectAxis, a major personal loans provider, and led FNB’s personal banking cluster. His expertise in direct and personal finance channels makes him well-suited to lead WesBank into a future where digital and flexible financing options increasingly dominate.

Be smart: Simply put, expect WesBank to double down on digital ease, dealer collaboration, customer-first experiences, and sustainability to maintain its dominance in South African vehicle finance while expanding the scope of its financial services offering in the automotive space.

Read more

Nedbank Enters South Africa’s Mobile Market with Nedbank Connect

Why it matters: Nedbank, one of SA’s top four banks, has launched Nedbank Connect — a mobile virtual network operator (MVNO) powered by MTN’s infrastructure. This isn’t just another phone plan; it’s a strategic push blending banking and telecom to build stronger customer loyalty and open new revenue streams.

Zoom In: Nedbank Connect offers month-to-month contracts with no penalties, customisable data plans, and innovative group SIM management, catering to families and small businesses. Starting at R169 for unlimited calls, SMS, and 3GB data, it challenges traditional telcos and extends Nedbank’s digital ecosystem.

So what: This move signals a broader fintech trend of banks expanding beyond finance into adjacent digital services, creating more seamless customer experiences.

Stay tuned for how this shapes Nedbank’s customer engagement and digital growth.

Read more

International Giant Access Bank Eyes South African Market with R2.8 Billion Bid for Bidvest Bank

Why it matters: Nigeria-based Access Bank is about to make a big splash in South Africa’s banking scene by acquiring Bidvest Bank for R2.8 billion. This deal is expected to reshape regional banking dynamics and strengthen Access Bank’s footprint in one of the continent’s most competitive markets.

The Recap: Bidvest Bank, a niche but full-service South African bank offering everything from foreign exchange to fleet and personal financial products, has been put on the market as part of Bidvest Group’s financial services portfolio streamlining. Access Bank, which already boasts over 60 million customers worldwide across 700 branches in 23 countries, agreed to the buyout in December 2024. The sale is pending regulatory approval and expected to finalize within three months.

The Situation Now: Access Bank plans to merge Bidvest Bank with its existing South African arm to create a bigger, more competitive regional powerhouse focused on delivering trade and retail banking solutions across the Southern African Development Community (SADC) region.

So what? This acquisition spells a strategic win for Access Bank, widening its pan-African ambitions and offering South African customers a fresh banking alternative backed by continental strengths. For South African consumers and SMEs, this could mean enhanced trade finance options and access to a broader regional banking network.

The Scoop

The Jannie Mouton Foundation’s R7.2bn bid to buy Curro Holdings is poised to be the largest education donation in South African history. The aim? Turn Curro into a nonprofit reinvesting profits into scholarships and schools.

Takealot’s new Home Loan Hub lets South Africans shop for mortgages online like they shop for groceries—with instant pre-approvals, lender comparisons, and R20,000 in voucher rewards on approved loans.

Absa’s new CEO, Kenny Fihla, raids Standard Bank, his former employer, for top talent, gearing up for a growth sprint in a banking warzone.

Crypto meets stocks as Luno ropes in 10,000 South Africans buying tokenised US stocks within the first month of launch, proving global investing is no longer rocket science.

+This

On This Day: September 4

Back in 1998, Google was founded: a reminder that even the biggest game-changers started small. Whether Shoprite’s banking ambitions or Luno’s tokenised stocks, today’s disruptors might just become tomorrow’s giants.