- The Banking Brief

- Posts

- Starling's AI chatbot, Walmart's Fintech Run and more

Starling's AI chatbot, Walmart's Fintech Run and more

3-minute read

Everything

1 Big Idea: Starling’s AI chatbot redefines money analytics

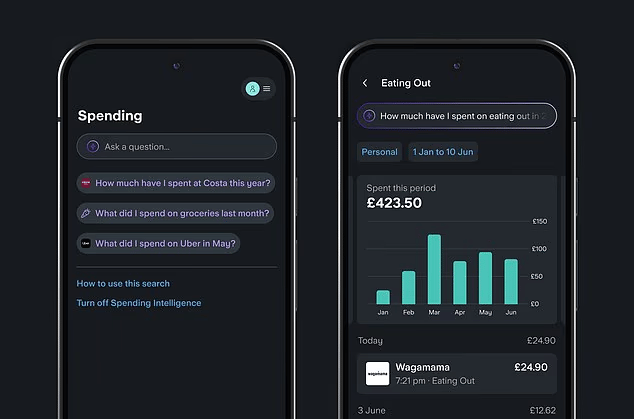

Starling Bank (UK digital bank) launches the UK's first customer-facing genAI tool, shifting chatbots from basic service to personalized finance insights.

Why it matters: It sets new standards for hyper-personalized banking while avoiding regulatory landmines by focusing strictly on spending analysis—not financial advice.

Driving the news:

Powered by Google Gemini (generative AI model), it answers natural-language queries like "Show my December dining spend" with instant charts.

Free for all 4.6M+ customers, with opt-in privacy controls and zero data sharing with Google.

Zoom in:

AI suggests prompts based on user behavior:

Frequent travelers see vacation spend trackers; foodies get restaurant analytics.

Essentially - The more you interact, the more you’ll learn about your money habits.

Hang on: Avoids savings/investment guidance due to regulatory boundaries—limiting its utility as a full money coach.

Be smart: Starling is trading monetization for data gold. Deep spending insights could fuel future products (e.g., dynamic budgeting) while locking in user engagement.

The bottom line: This isn’t just a chatbot—it’s a Trojan horse for habitual financial self-education.

2. Walmart’s fintech end-run

Why it matters: After dumping Capital One, Walmart’s OnePay fintech arm launches two Synchrony-backed credit cards—accelerating retail’s banking disruption.

What we found:

General Mastercard + Walmart store card target underbanked shoppers.

OnePay handles UX; Synchrony (financial services firm) manages underwriting (credit risk assessment).

How it works:

Non-qualifiers for Mastercard get downgraded to store card—capturing marginal borrowers.

Follows OnePay’s partnership playbook (e.g., Klarna BNPL/Buy Now Pay Later) to build a finance ecosystem.

Hang on: Retail cards historically exploit low-income users with 25%+ APRs (annual percentage rates)—will OnePay avoid this?

The bottom line: Retailers are becoming banks with better distribution.

3. The Scoop

Plaid (financial API company) enables real-time business payments via RTP® Network—slashing ACH (automated clearing house) delays for firms like Carvana.

Stripe (payment processor) acquires crypto wallet startup Privy, doubling down on blockchain after $1.1B stablecoin move.

Revolut (digital bank) targets 2026 Spanish business banking launch—exploiting BBVA-Sabadell (Spanish banks) merger chaos.