- The Banking Brief

- Posts

- 🔥 Stripe Lands in Kenya: M-Pesa Payouts Unleash Global Reach for African Businesses

🔥 Stripe Lands in Kenya: M-Pesa Payouts Unleash Global Reach for African Businesses

6 min read

The Banking Brief is For fintech leaders scaling cross-border commerce in emerging markets

July 22–26, 2024 | 6-minute read

💡 Why This Launch Changes Everything

Whew! This has been a long time coming!

You might remember when Stripe acquired Paystack for a cool $200 Million Dollars, looks like its finally paying off.

Stripe’s entry into Kenya via Paystack isn’t just another market expansion.

It’s HUGE.

This is a strategic bypass of Africa’s fragmented payment infrastructure. By integrating M-Pesa (Think E-wallet, Cash-App, Venmo used by 96% of Kenyan adults), Stripe enables:

Instant USD/KES settlements for global platforms like Shopify and Zoom

One-click payouts to 30M+ M-Pesa wallets—slashing remittance costs by 60%

No-code commerce tools for SMEs to accept Apple Pay, cards, and mobile money in one flow

Today’s a goodie. Let’s get into!

“Stripe does all the hard work in the background. Local payment methods no longer block regional expansion.” — BigCommerce

🌍 The M-Pesa Multiplier Effect

Safaricom’s mobile money giant is actually Kenya’s financial backbone:

$314B/year in transactions—half of Kenya’s GDP flows through M-Pesa - that’s like saying half of South Africa’s GDP flows through E-wallet, Instant Pay or Payshap

2.5M SMEs use it daily, with post-COVID digital payments surging 47%

Global partnerships with Amazon, Visa, and now Stripe cement its infrastructure role

Stripe’s integration sidesteps Kenya’s exclusion from its global stablecoin rollout—an incredibly savvy pivot to East African local reality.

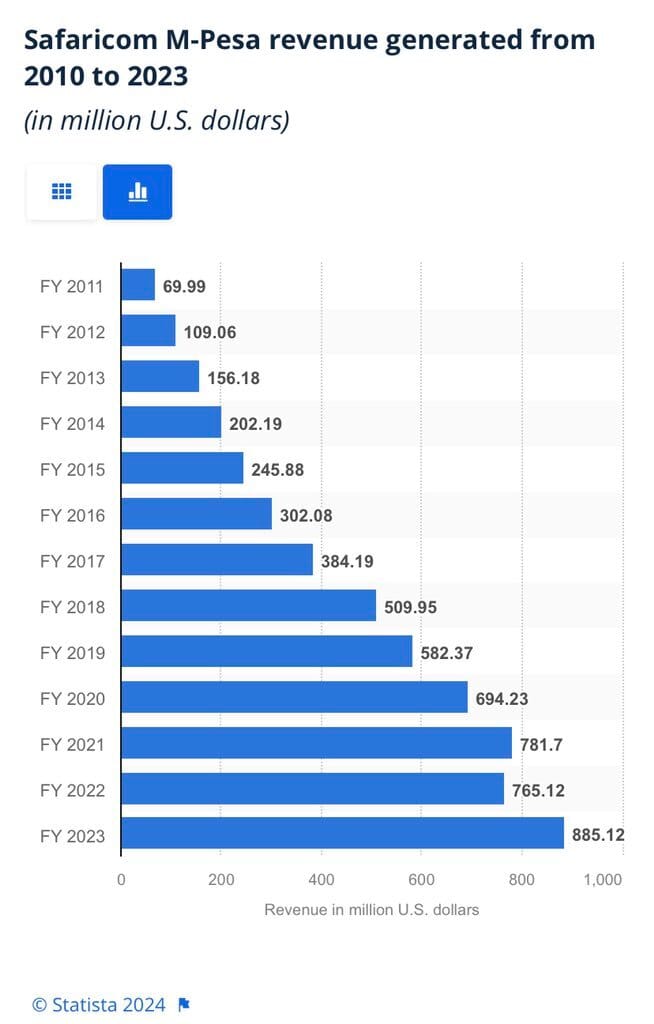

M-PESA Revenues in USD

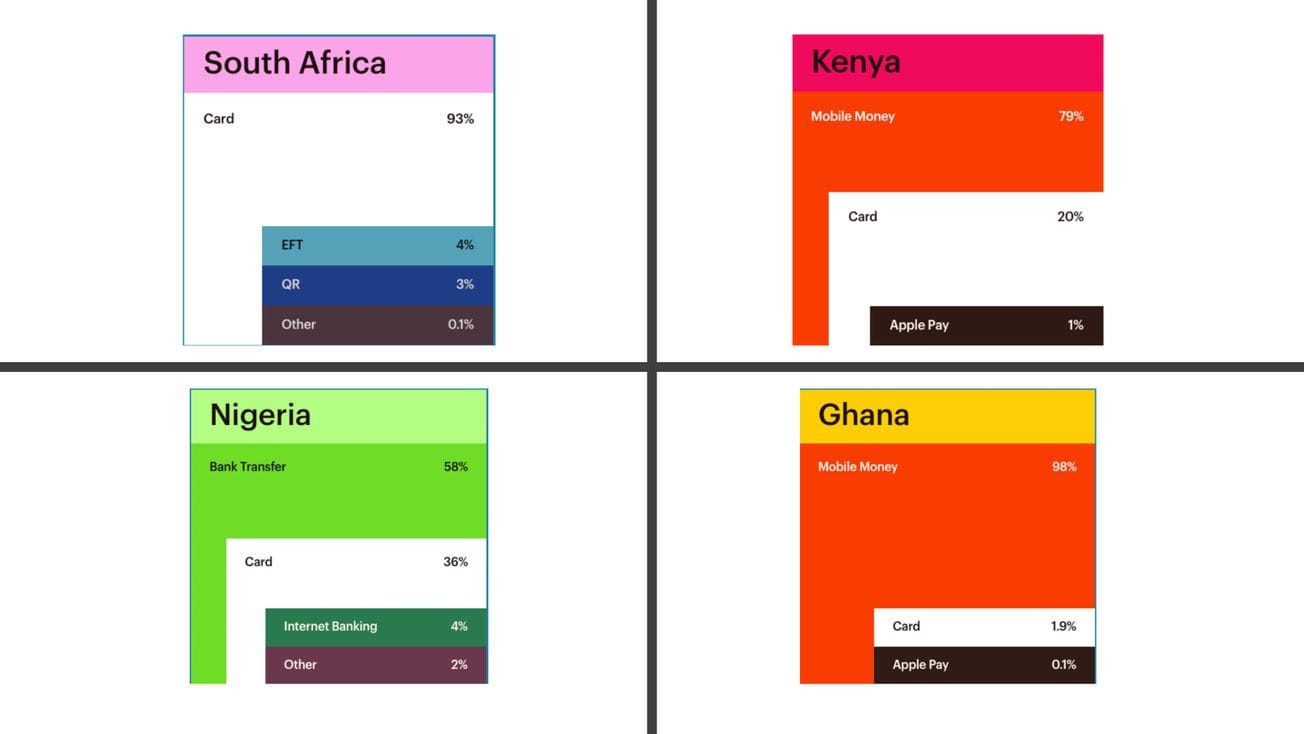

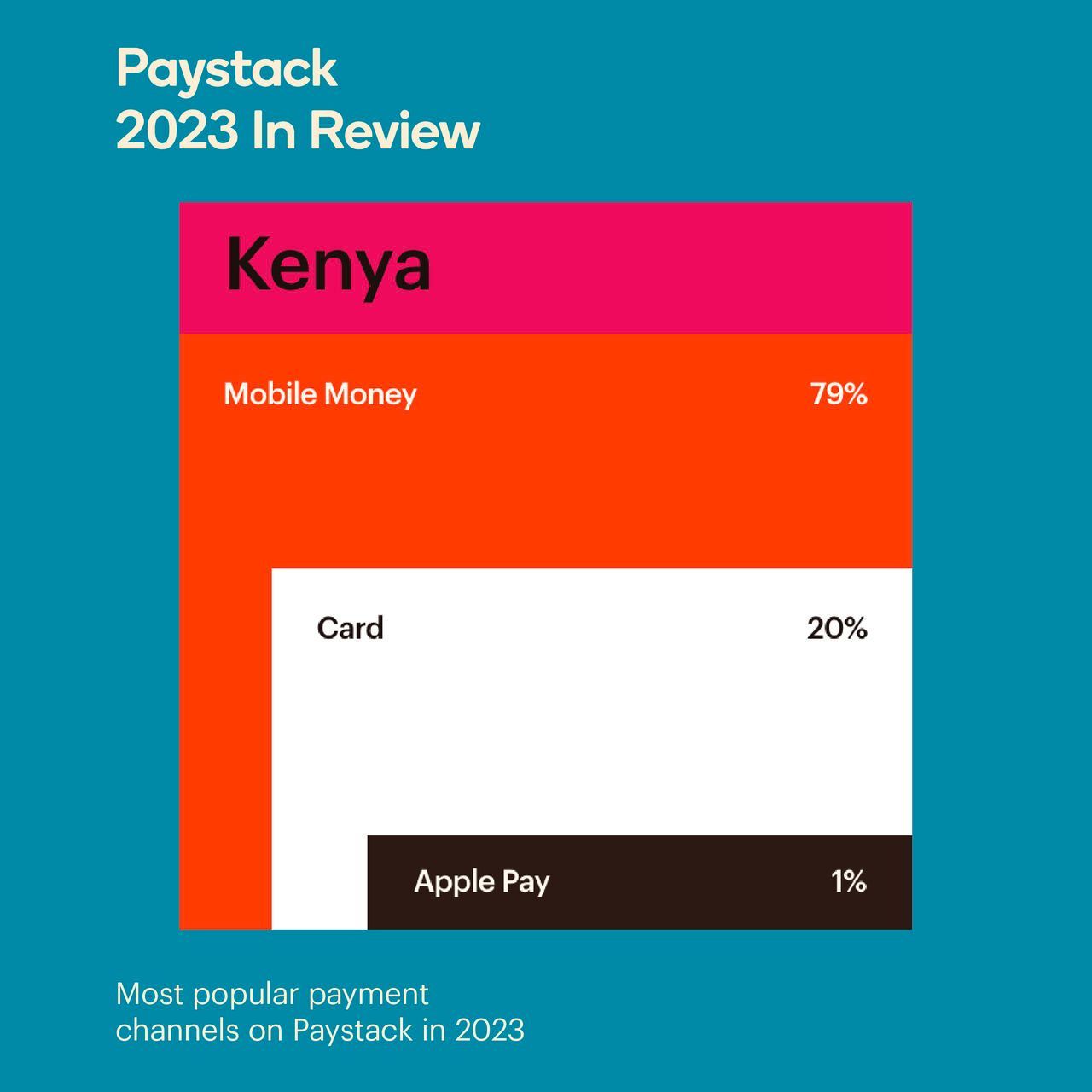

Most Dominant payment channels for customers who use Paystack via Paystack

Most Dominant payment channels for customers who use Paystack via Paystack

Competitive Landscape: Who Wins/Loses?

Player | Positioning | Vulnerability |

|---|---|---|

Flutterwave | Dominant pan-African processor | Losing SMEs to Paystack’s no-code tools |

M-Pesa Africa | Revenue up 38.3% YoY | Now funding rivals via Stripe payouts |

Visa/Mastercard | Partnered with M-Pesa for virtual cards | Outflanked by Stripe’s full-stack platform |

Local Processors (PesaPal, Cellulant) | Deep regional merchant ties | Volume drain to global-grade APIs |

The Tension: Stripe’s M-Pesa payouts could ironically boost M-Pesa’s dominance while undermining local fintechs .